Sustainability Rulebook: The Corporate Sustainability Due Diligence Directive

What is the CSDDD?

If adopted, the European Commission’s proposal for a Corporate Sustainability Due Diligence Directive (CSDDD) would require companies to establish due diligence procedures to address adverse impacts of their actions on human rights and the environment, including along their value chains worldwide. The aim is to foster sustainable and responsible corporate behaviour and to introduce sustainability considerations in companies’ operations and corporate governance.

The CSDDD is part of the European Green Deal – a set of policy initiatives by the European Commission with the overarching aim of making the European Union's climate, energy, transport and taxation policies fit for reducing net greenhouse gas emissions by at least 55% by 2030, compared to 1990 levels, and climate-neutral by 2050. Together with existing regulations and other regulatory initiatives such as the Corporate Sustainability Reporting Directive (CSRD) or the EU Taxonomy Regulation, the CSDDD represents a further step towards sustainable business under uniform European conditions.

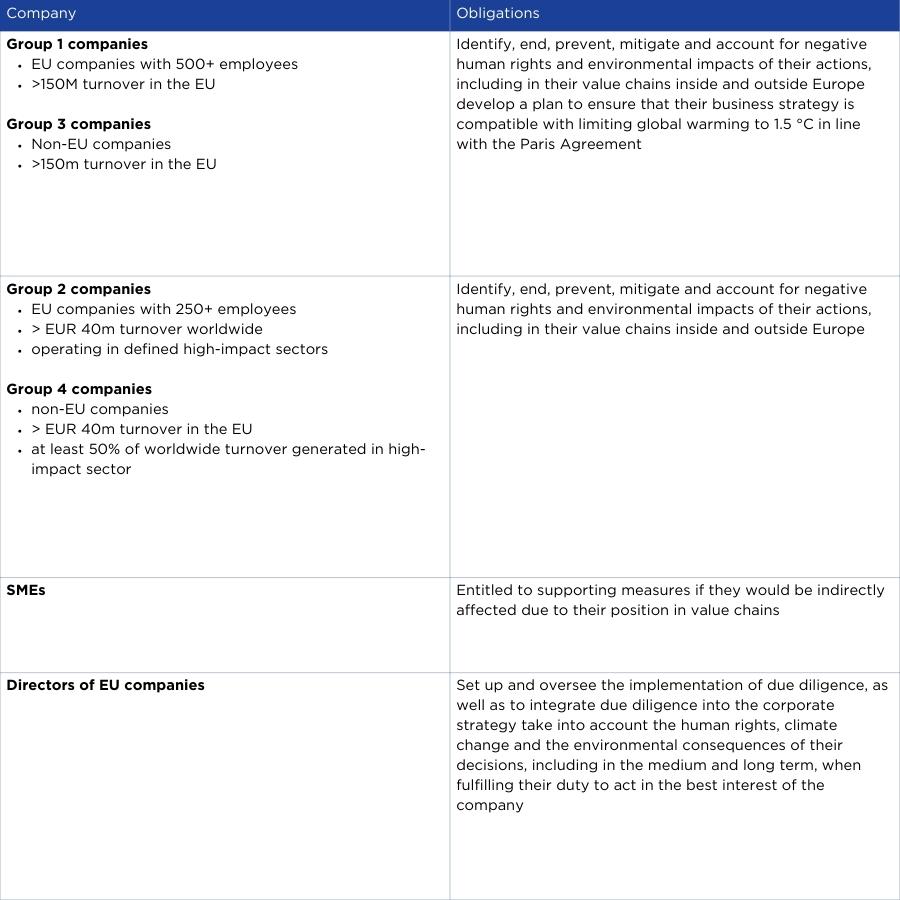

Which obligations will apply to whom?

The CSDDD imposes different obligations on different types of companies (see overview table below). All companies within its scope will have to implement due diligence measures to identify, end, prevent, mitigate and account for negative human rights and environmental impacts of their actions. For instance, due diligence would imply developing and implementing “prevention action plans”, obtaining contractual assurances from direct business partners, and subsequently verifying compliance. Companies covered by the directive would need to ensure due diligence not just regarding their own operations, but also regarding the activities of all entities in their value chains with which they have direct and indirect business relationships.

Companies with a turnover of more than 150 million Euro (group 1 & 3 below) will also have to develop a plan to ensure that their business strategy is compatible with limiting global warming to 1.5 °C in line with the Paris Agreement. Companies that identify climate change as “a principal risk for, or a principal impact of,” their operations would have to include emissions reduction objectives in their business plans.

Notably, the Commission’s proposal would achieve senior-level responsibility for sustainability. Directors of EU companies would be responsible for setting up and overseeing the implementation of due diligence, as well as integrating due diligence into the corporate strategy. The CSDDD adds consideration of human rights, climate change and environmental consequences to the existing fiduciary duty of directors to act in the best interests of the company.

The Commission may issue guidelines for specific sectors or specific adverse impacts in consultation with Member States and stakeholders, the European Union Agency for Fundamental Rights, the European Environment Agency, and where appropriate with international bodies having expertise in due diligence.

What human rights and environmental impacts are covered?

For due diligence, the CSDDD aligns with the main international human rights and environmental law standards. However, it only covers those rights and prohibitions specifically listed in the Annex to the proposal as well as any human rights risks that are foreseeable. The list includes a range of labour rights, the prohibition of interference with freedom of thought, conscience and religion, and the right to freedom of association, assembly, the rights to organise and collective bargaining. Although freedom of expression is not explicitly listed, it would presumably still fall within the scope of due diligence of any media organization given its operational context.

The list also includes certain violations of international environmental law concerning, for instance, the handling, collection, storage and disposal of waste, or the use of biological resources that could have adverse impacts on biodiversity. Companies with more than 500 employees and at least EUR 150m turnover will also have to ensure that their business model and strategy are compatible with the transition to a sustainable economy and with the limiting of global warming to 1.5 °C in line with the Paris Agreement. Companies that have or should have identified climate as a principal risk for or a principal impact of their operations, should include emissions reduction objectives in their plan.

Note that the CSDDD does not cover the entire range of sustainability or ESG (Environmental Social Governance) standards. The latter include, for instance, considerations of diversity and inclusion or anti-corruption, but would not be covered by the CSDDD.

How will the new rules be enforced?

The CSDDD will be enforced at Member State-level. The Commission proposes three enforcement mechanisms: administrative supervision and sanctions, civil liability, and financial incentives.

-

Administrative supervision and sanctions: Member States would designate an authority to supervise and impose administrative sanctions, including fines and compliance orders. At the European level, the Commission will set up a European Network of Supervisory Authorities that will bring together representatives of the national authorities to ensure a coordinated approach. Natural and legal persons would be entitled to submit “substantiated concerns” to any supervisory authority alleging that a company is failing to comply.

-

Civil liability: Member States will ensure that victims have access to compensation for damages resulting from the companies’ failure to comply with their due diligence obligations.

-

Financial incentives: Implementation of the emission reduction plans will be embedded in the financial incentives of directors of EU companies by linking their variable remuneration to their contribution to fulfilling these plans.

Part of the CSDDD would be enforced through existing Member States' laws. For instance, the CSDDD does not foresee an additional enforcement regime in case directors do not comply with their obligations under this directive. However, Member States would have to amend their laws and regulations on directors' duties, adding consideration of human rights, climate change and environmental consequences to their existing fiduciary duties. This will have various implications under domestic company law. For instance, shareholders may be able to sue directors who violate this fiduciary duty. The CSDDD may even add to the risk of sustainability-related strategic litigation, which has become a growing concern for companies.

The current state of the CSDDD

The CSDDD was proposed by the Commission in February 2022. In December 2022, the European Council finalised its general approach. It proposes to narrow the scope to cover only EU companies with more than 1,000 employees and EUR 300m net worldwide turnover, and non-EU companies with EUR 300m net turnover generated in the EU. By contrast, members of the European Parliament (MEPs), where the proposal is still awaiting Parliament’s position, seem inclined to expand, rather than narrow, the scope of the CSDDD to a wider range of companies.

The Council also rejected the Commission's proposal that due diligence should fall under the directors' fiduciary duty of care. Instead, due diligence processes should be incorporated into risk management systems and company policies. It also deleted the original proposal to base variable remuneration on directors' contributions to sustainability. By contrast, MEPs might be inclined to broaden the scope of environmental issues to include more obligations related to nature and biodiversity as well as climate-related objectives.

The CSDDD is expected to enter trilogue negotiations later in 2023 with the aim of adopting the directive by 2024. Its rules will not become applicable before 2025 at the earliest.

The CSDDD doesn’t apply to me – why should I care?

Many PSM will not be covered by the CSDDD because they are public entities. While not required to implement due diligence procedures, Members could still be affected in virtue of their direct or indirect business relationship with the relevant companies. Concretely, in-scope companies that deal with PSM might ask for contractual assurances and subsequently verify compliance.

Members might also choose to establish due diligence procedures on a voluntary basis. Sustainability due diligence could be set to become a common business practice in the media sector. Social and environmental considerations are becoming an essential part of consumer decisions. Feeling overwhelmed or powerless themselves, many people look to companies and public entities to take the lead on climate change. [1] PSM have an opportunity to strengthen their legitimacy and the trust of their audiences by leading on these issues. On the other hand, violations of human rights or environmental law resulting from failures of due diligence risk significantly harming PSM’s reputation, its relationship with audiences and other stakeholders, and its authority to hold others accountable.

Contact Details

Sophia Wistehube

Legal Counsel

Legal & Policy

wistehube@ebu.ch

Related Links

Sustainability Summmit 2023

EBU Climate Journalism that Works

Sustainability: An Outline of Public Service Media Involvement

ENDNOTES

[1] EBU Media Intelligence Service, Hot Media Trends 2023 (January 2023, Member exclusive)